【Setting up a company by yourself】A 100% instruction guide to DIY a company! To teach you step by step setting up a limited company in Hong Kong by yourself

Since the establishment of CountAudit, many customers have requested us to help setting up companies. As the service is relatively simple, we are willing to do it for free. However, we would like to write a piece of clear and complete ‘instruction’ so that more people can benefit from setting up a limited company on their own and saving money on other agents.

Online setting up companies ㄧ'E-Registry'

Here, we are not going into details about the characteristics, advantages and disadvantages of limited companies as they have been discussed in the previous article. The Government Companies Registry is responsible for the registration of limited companies. We can submit the company registration application in person at the Companies Registry office (14th floor of the Government Offices). However, submitting an application online through ‘e-Registry’ is a more convenient and efficient alternative as it reduces errors and shortens approval time.

We have to prepare the following 5 items before using online ‘e-Registry’ to set up limited companies.

- 'E-Registry' account

- Company name

- Relevant fees

- Company address

- A partner

- Electronic equipment

Prior preparation

'E-Registry' account

You have to register as user on ‘e-Registry’ before using it. You can register by clicking the link below. The registration is free of charge. It only takes 5 to 10 minutes to complete the registration. After registration, you are required to go to the Companies Registry Office (13th floor of the Government Offices) to confirm your identity before you can officially activate your account.

No cost is needed to apply for an ‘e-Registry’ account. You can register as user even if you do not have the need to set up a company at the moment. Therefore, we recommend you to do the registration whenever you have time.

【Registration link】https://www.eregistry.gov.hk/icris-ext/apps/uam01?execution=e2s1&m=n

【Registration procedures】(You can use any computer or mobile devices)

After entering the link and reading the relevant terms and conditions, click ‘Accept’.

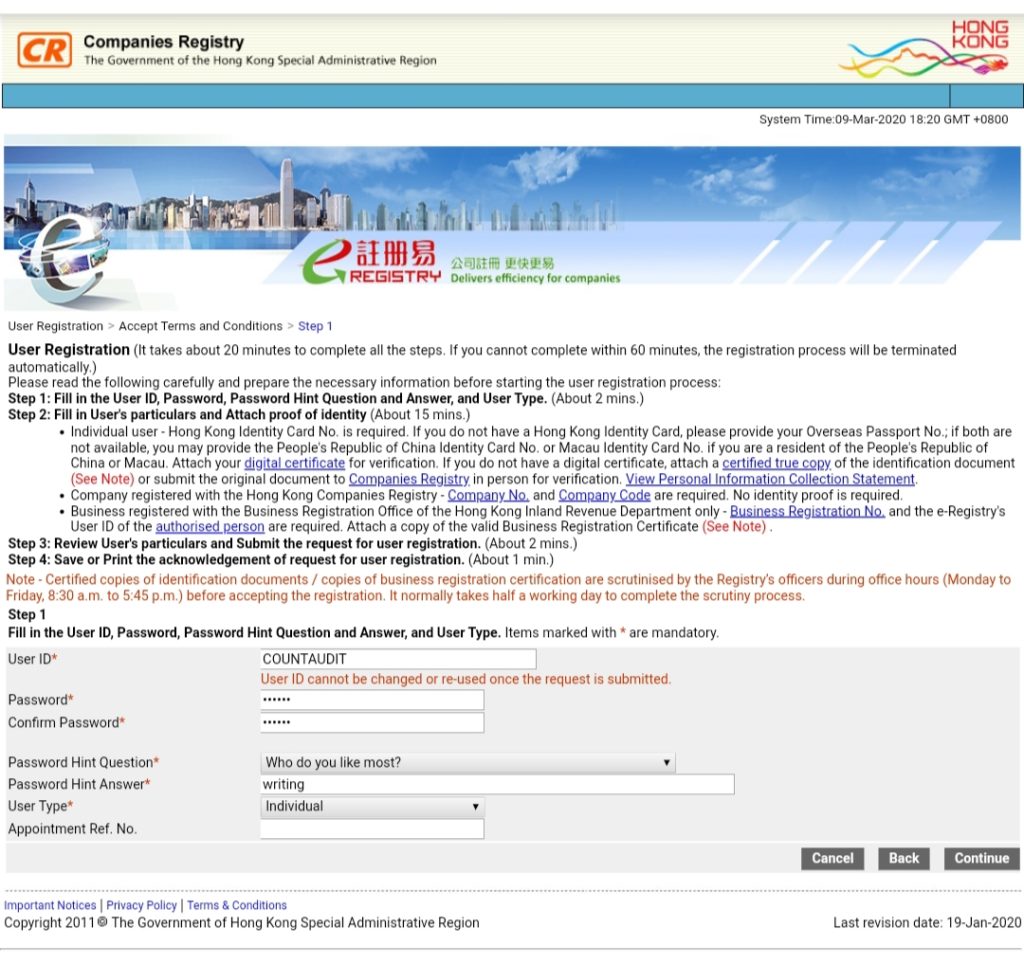

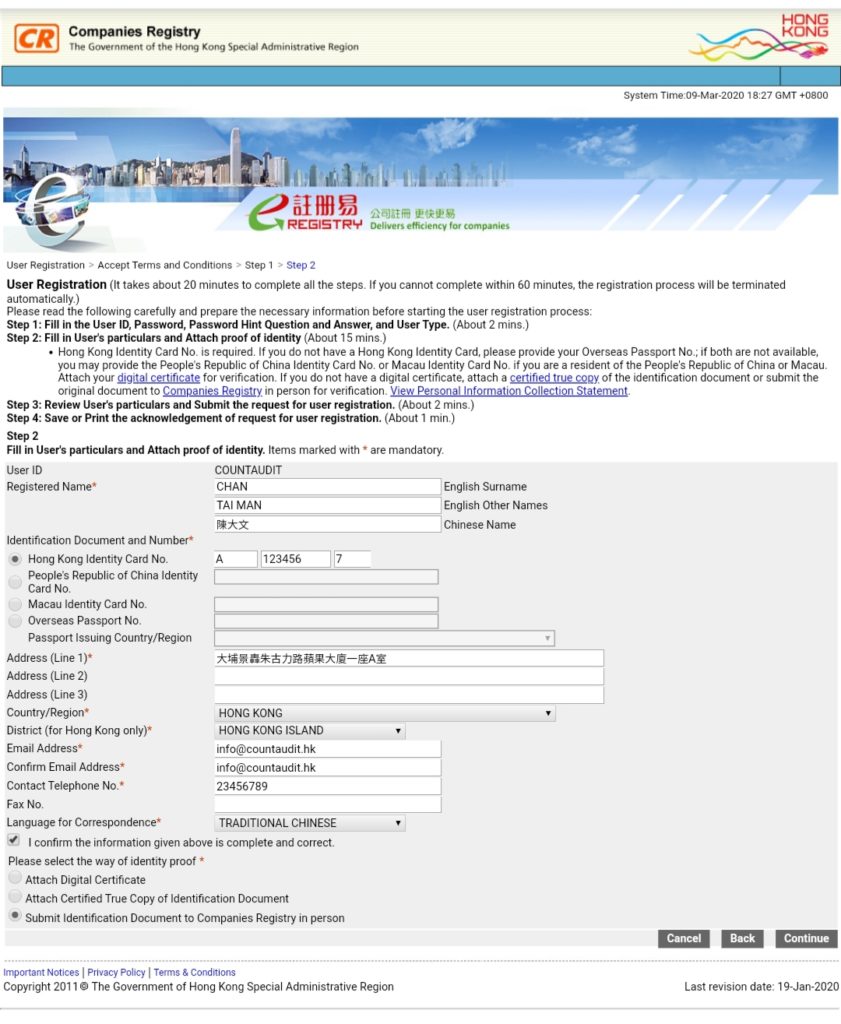

Fill in the custom User ID and Password on the 1st to 3rd row (for login later on). Fill in the Hint Question and Hint Answer when you forget password on the 4th and 5th row. Choose ‘Individual’ in User Type on the 6th row. Leave the 7th row blank. Then, click ‘Continue’.

Fill in your full English and Chinese name shown in identity card on the 2nd to 4th row. Fill in your identity card no. on the 5th row. Fill in your usual Hong Kong address on the 10th to 14th row. Fill in your email address and contact telephone no. on the 15th to 17th row. Fill in your preferred language on the 19th row. Please tick the box to confirm the information given is complete and correct. Select ‘Submit Identification Document to Companies Registry in person’ for the way of identity proof. Then, click ‘Continue’ .

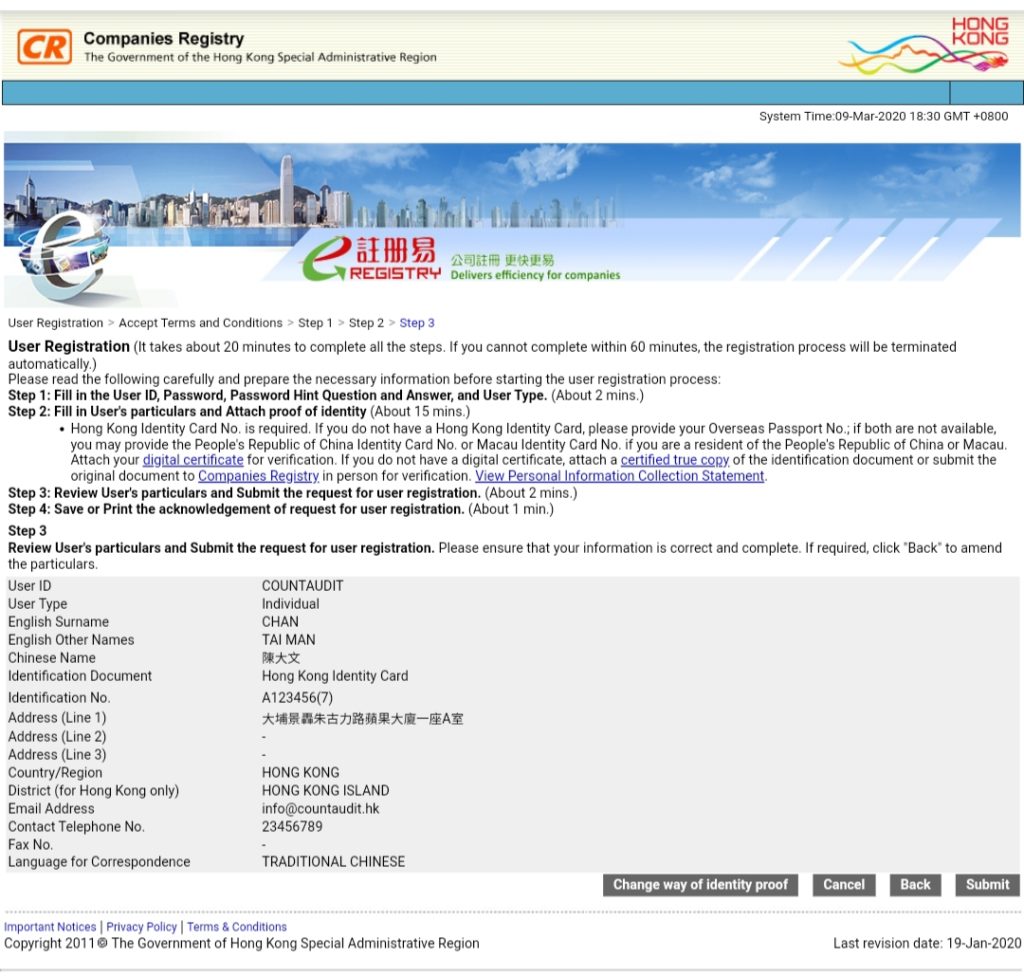

Click ‘Submit’ after ensuring that the information filled in is correct and complete.

Registration completed! Please print out the acknowledgement with the application no. on it. Produce the application no. with your identity card to officers in the following address during service hours. Generally, registration will be approved within a few hours. An email will be sent to the email address you provided after approval.

【Address】

香港金鐘道66號金鐘道政府合署高座13樓,公眾查冊中心

Public Search Centre, Companies Registry, 13th floor, High Block, Queensway Government Offices, 66 Queensway, Hong Kong

Company name

As the owner of the company, you possess the absolute freedom to decide your company name. However, Companies Registry has some basic limitations towards the company name:

- The company Chinese name must end with「有限公司」four words;

- The company name should be different from any other companies or legal entities;

- Registrar considers the use of the company name would constitute criminal offences; or

- Registrar considers the company name is offensive or in conflicts with social interests by other reasons.

Now we will briefly introduce how to check whether the drafted company name has been used or not:

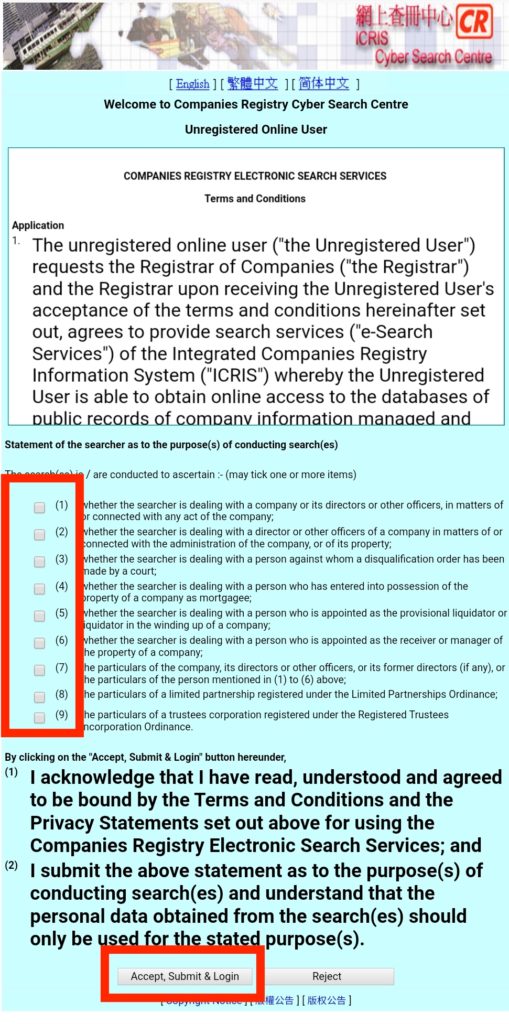

After entering Cyber Search Website and reading their announcements, scroll down to the bottom of the page and click ‘To enter Companies Registry Cyber Search Centre…’.

Then, click ‘Unregistered User’ to enter Search Centre.

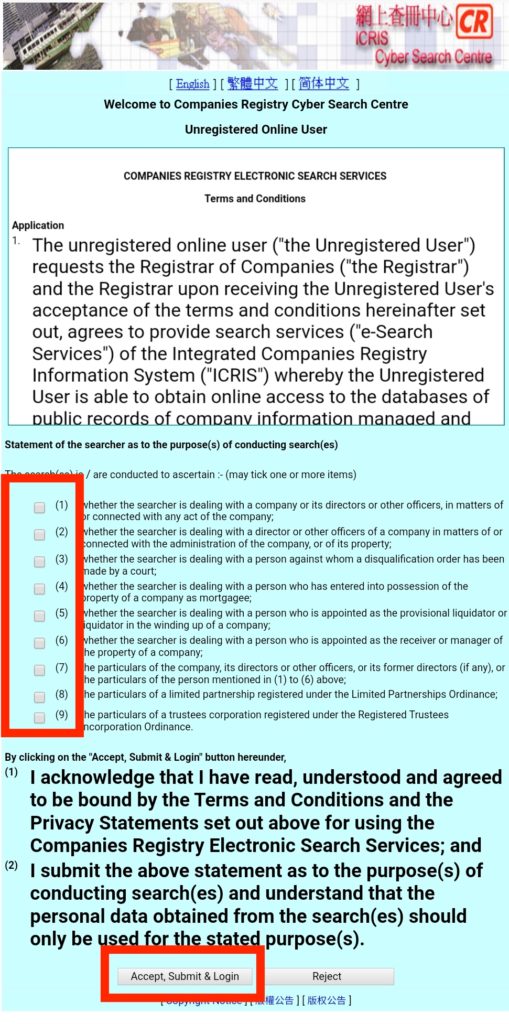

You will be required to fill in their questionnaire. Randomly tick a box in (1)-(9) and click ‘Accept, Submit & Login’.

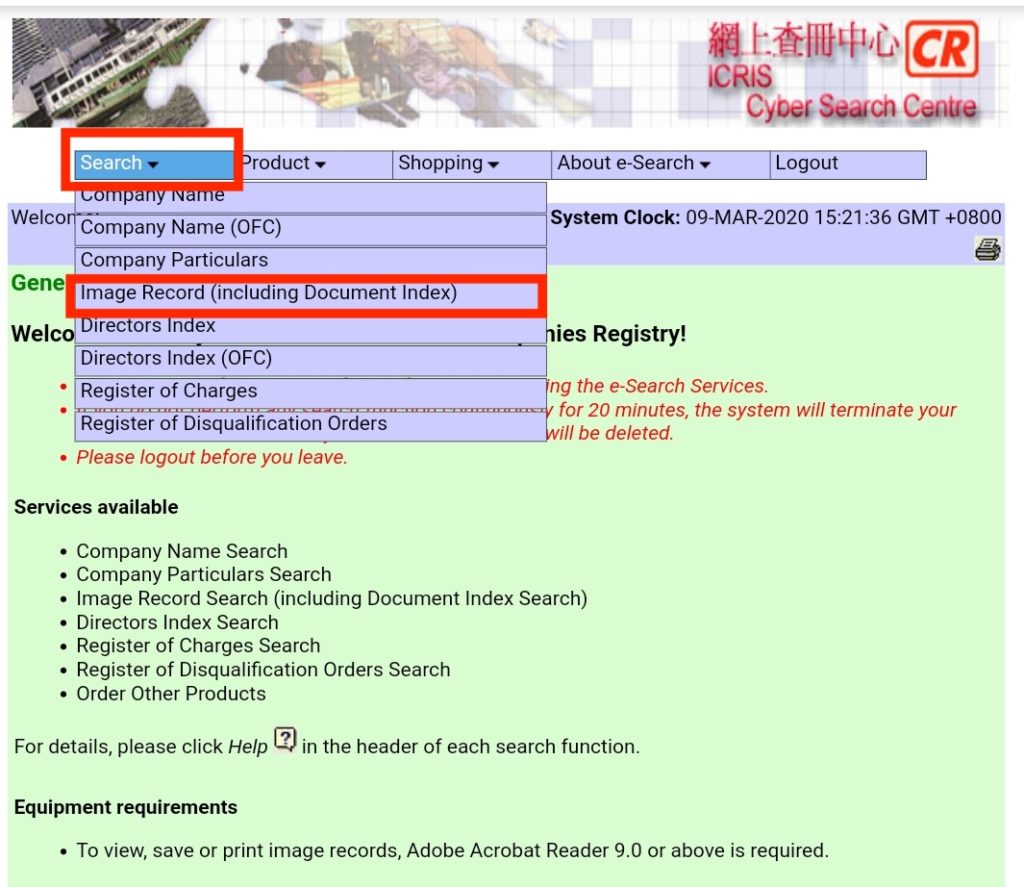

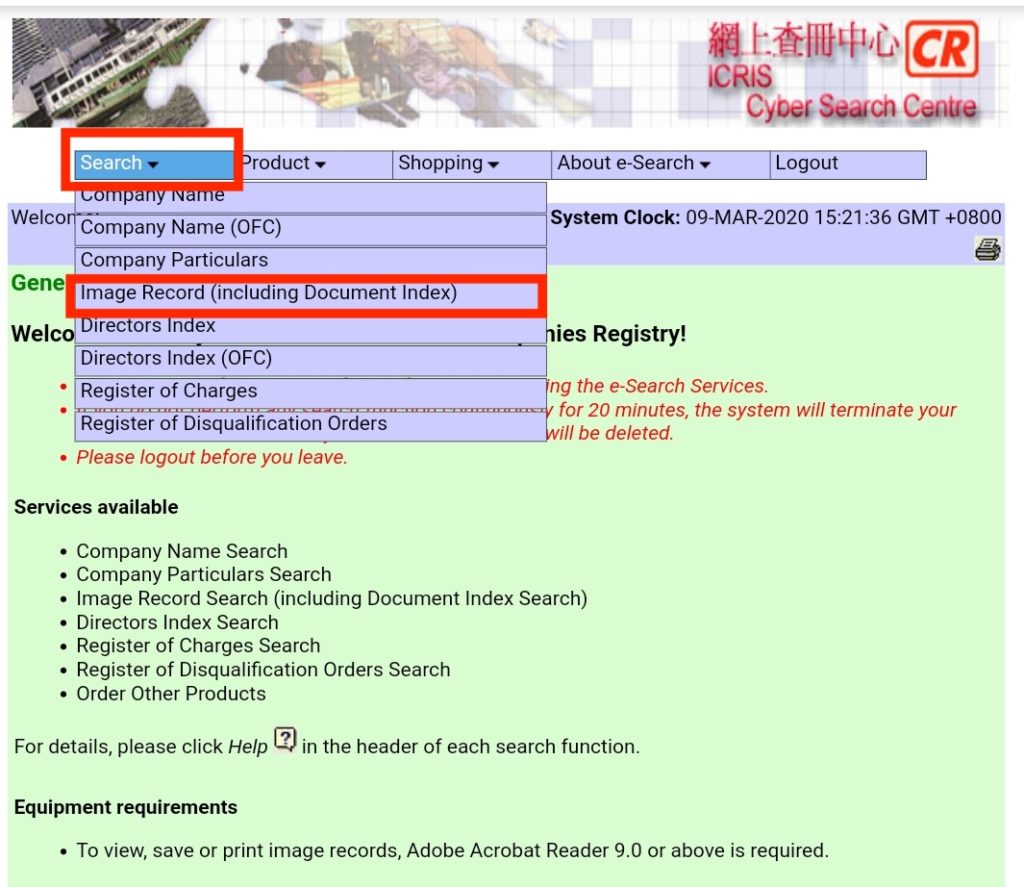

Click ‘Search – Image Record (including Document Index)’ under the header banner after entering the Search Centre system.

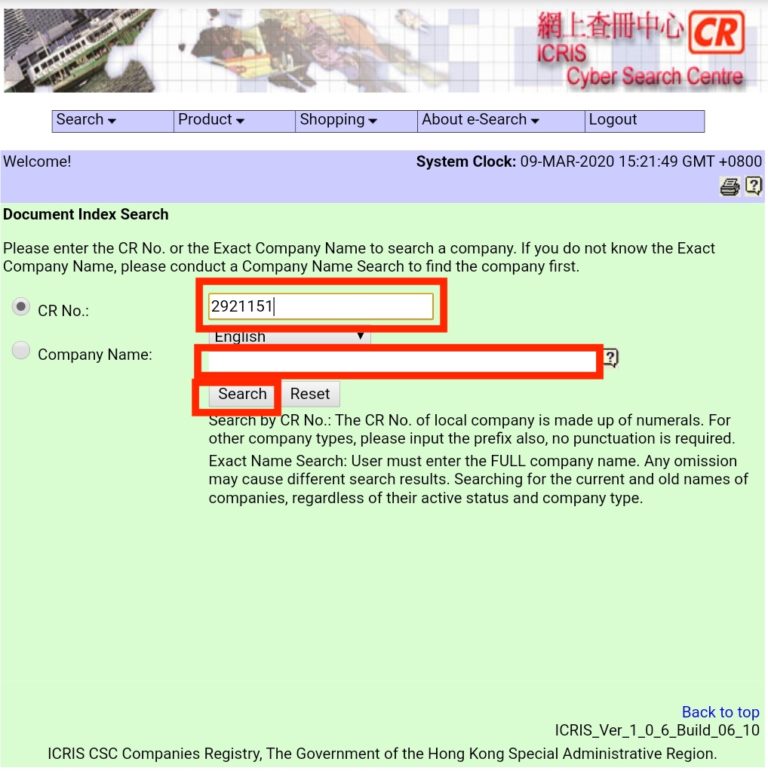

Type in your drafted company name and click ‘Search’. If it shows the exact same result as the company name you typed in, your drafted company name will be unavailable, vice versa.

Relevant fees

Fees upon registration are as follows (As at March 2020)

Fees | HK$ |

|---|---|

Company registration fee | 1,425 |

Company document storage fee | 295 |

First year business registration levy | 250 |

First year business registration fee | 2,000 (business registration fee has been waived for 2020-2021) |

You can pay with visa/mastercard credit cards or paypal on ‘e-Registry’ for company registration.

Company registered address

Please first prepare the business address for your company. Address is an important information for the company. It can be changed by submitting forms at any time after the establishment of company.

The company registered address can be your home address. However, please be noticed that company registered address is public information that general public can read upon searching.

You are suggested to ‘buy’ an address if you do not have any physical offices. You can see many choice when you search ‘virtual offices’ in Google. The price is currently HK$40 to HK$120 per month which depends on districts of the addresses. The price usually covers mail collection service and sometimes forwarding mails to specified address as well.

A partner

We have mentioned in the previous passage that we need at least two people to set up a limited company. There are mainly the following two situations:

- If there are two directors, one of them can be appointed as company secretary.

- If there is only sole director, the sole director has to appoint another person instead of himself to be the company secretary.

It does not matter if you really do not have a partner to do business with you. I would recommend you to use Plan#2. The reason is that Plan#2 only requires name, address and identity card these personal information of the secretary to be filled in when setting up a company. The secretary does not need to sign. While for Plan#1, both directors are required to sign and administrative procedures are more troublesome.

You may wonder then who can be company secretary? Do I need to patronise secretarial company?

The answer is that all permanent residents who often live in Hong Kong can be company secretary of a limited company. A company (legal entity) can also be company secretary of another company as long as it has a registered address or business location in Hong Kong.

The only exception is listed companies. The company secretary of a listed company has to be a natural person (not a company). He or she also has to possess ‘Chartered Secretary International Qualification’ issued by The Hong Kong Institute of Chartered Secretaries (HKICS).

It is known that many friends asked their wives or mothers to be company secretaries when setting up companies. It is feasible. However, they should be responsible for the relevant company secretarial tasks, including keeping secretarial documents, submitting annual returns regularly, compiling AGM minutes etc. Details will be discussed later.

Electronic equipment

Not long ago, if you would like to use ‘e-Registry’ to set up a company, you need to do it on a browser that supports Java SE Runtime Environment. That means you can only use Internet Explorer that everyone in the past knows, even Edge and Chrome are not available.

The innovative and supportive Government finally updated ‘e-Registry’ in December 2018, making it available on more systems and browsers:

- Operating system: Windows 7/10、macOS

- Browser: Internet Explorer (IE) 11/Edge、Google Chrome

- Software: Adobe Acrobat Reader 9.0 or updated versions

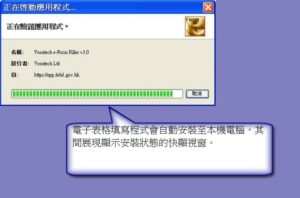

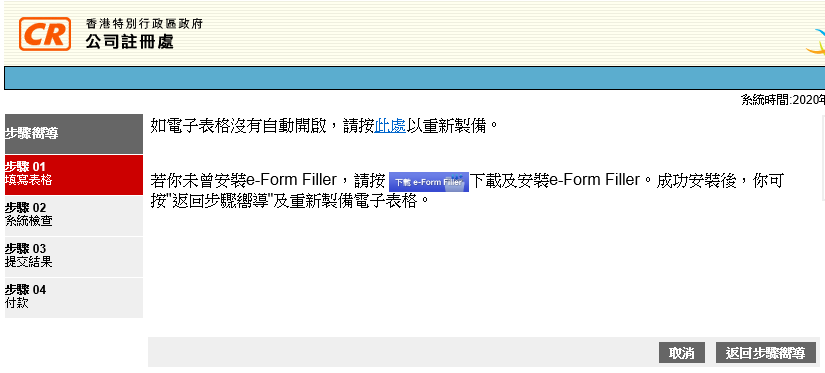

- You are required to install e-Form Filler. Please visit Companies Registry website and download according to the figure below:

Apart from computers, mobile devices like smartphones and tablets also support ‘e-Registry’. However, you have to install ‘CR eFiling’ mobile application beforehand.

If it is possible, we encourage everyone to use ‘e-Registry’ with Windows 10 and Internet Explorer browser to set up companies as it is more stable with no risk at all.

Setting up a company officially

Enter the page

Then, you can set up a company immediately! Once you have prepared the above 5 items, the following procedures are in fact rather simple that you can finish in 30 minutes.

Firstly, use the previous suggested electronic equipment login <e-Registry website>.

Click ‘User Login’ and use the previous custom user name and password to login ‘e-Registry’.

Click ‘Electronic submission service – Online submission’ on the left after login. Then, click ‘Local company’.

Click ‘Establish Company – Company Limited by Shares (Form NNC1)’ after entering the page.

Note: Company Limited by Shares is the simplest company type. If you would like to set up other special types of company (e.g. NGO, charity organisation etc.), please read other passages or contact us.

Select a language after entering electronic submission page. Then, click ‘Continue’.

Fill in basic company information

Select ‘Private’ in company type (public companies are usually listed companies). Select ‘Model articles of association’ in articles of association and select ‘Model articles A (simplified format)’. Then, click ‘Continue’.

(Choosing simplified model articles can speed up the processing procedures. It is suitable for entrepreneurs who have no special requirements on company rules like types of share.)

Fill in the custom company Chinese and English names as well as the registered address. Then, click ‘Continue’.

Note: The Chinese name must end with「有限公司」four words while the English name must end with ‘Limited’.

As mentioned before, the registered address can be virtual office address you bought beforehand or home address.

If there are no special requirements regarding equity and shares, you can simply follow and type as the above suggestion. Then, click ‘Continue’.

Fill in information of founding members

Then, start to fill in important personnel information. Firstly, tick the box ‘Founding member’ and on the pop-out form fill in information of the founding member (that is, the company owner, if you are not setting up the company for someone else, the company owner is you). Then, click ‘Add’ to save.

At least one founding member has to sign on subsequent electronic forms.

The total number of shares is 10,000. If you are the sole founding member, you can allocate all shares to yourself as shown in the above figure. The address should be filled with home address of the founding member instead of the company registered address. This is an important information to prove the usual residential address of important member in the company.

Apart from the above, it is reminded that the information filled in upon registration is public information as the general public can pay and do search after the company is successfully registered.

Fill in information of directors

After clicking ‘Add’, the previously filled information will be listed in the ’Information of Founding Member/Senior Staff‘ box. If there is no second founding member, tick the box ‘Director’.

Similar to the filling of founding members, we can fill in the information of directors (put it simple, it is the company manager) in the pop-out form. Founding members can also be directors.

It is reminded that the address should be filled in director’s own residential address instead of company registered address. Directors can choose to sign electronically in the subsequent electronic form, or submit the NNC3 consent form to the Registry within 15 days of registration. If you are director as well, you are suggested to tick the item ‘Director will sign…’ below and sign it electronically now.

Fill in information of company secretary

The last one is to add company secretary after adding directors. It is again reminded that if there is only one director, he or she cannot serve as company secretary. Company secretary is required to reside in Hong Kong for most of the time without the need to sign in any electronic forms or subsequent documents. You can find a reliable partner and tell him or her what a secretary should do (you can read the following passage or contact us if you are not familiar with that). Then, complete the blank by filling in the information of the company secretary.

Of course you can appoint a secretarial company registered in Hong Kong (e.g. CountAudit) as your company secretary. However, it requires relevant annual fees.

Finally, click ‘Continue’ after ensuring that there are at least one name for founding member, director and company secretary in the information box.

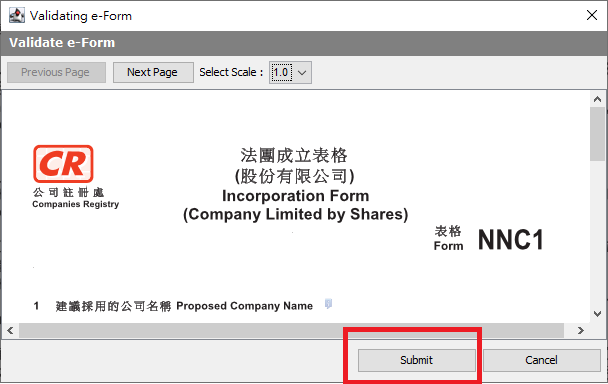

You almost finish it! After clicking ‘Generate electronic form’, the website will generate a statutory NNC1 Incorporation Form according to your information filled in.

If you have installed e-Form filler (or CR eFiling) in advance, the website will connect automatically and open the form.

Click ‘Allow’ when the above window appears.

Form checking

Check the incorporation form

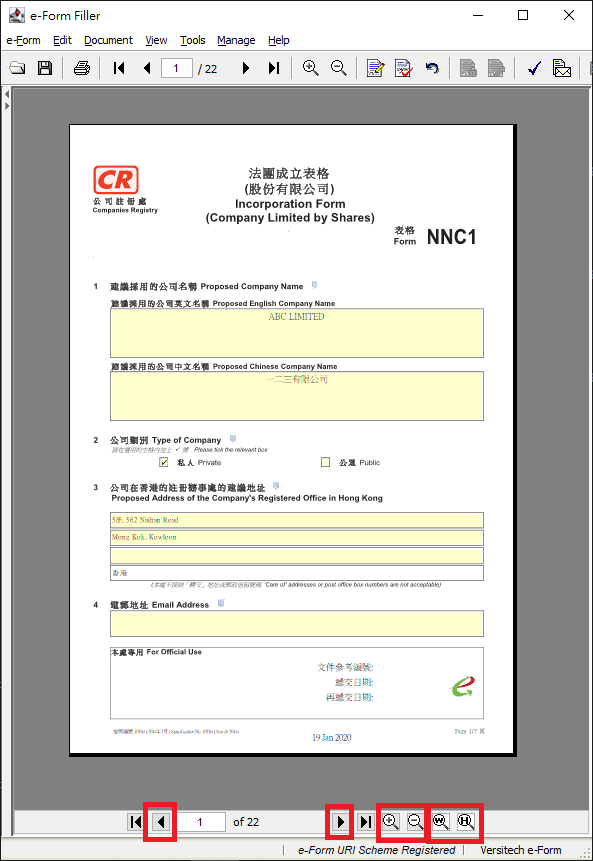

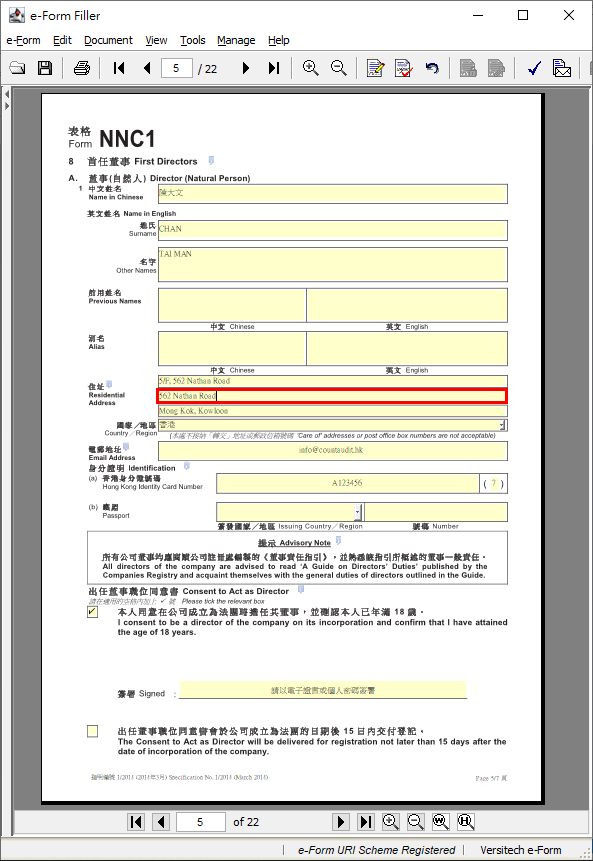

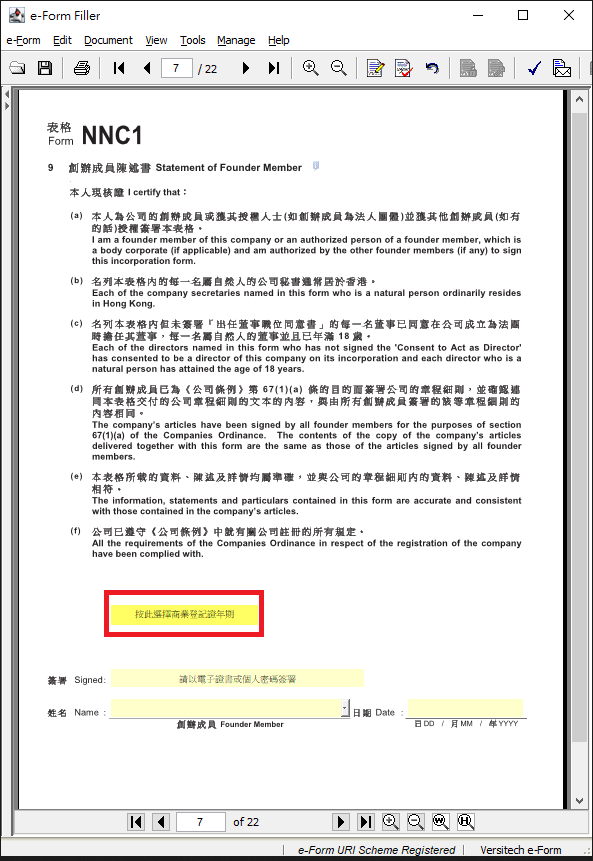

This is how the form connected with e-Form filler looks. You can read the NNC1 Incorporation Form by clicking buttons in the bottom to flip pages and zoom in and out. You can also click the yellow box to amend the content in the form.

Electronic signature

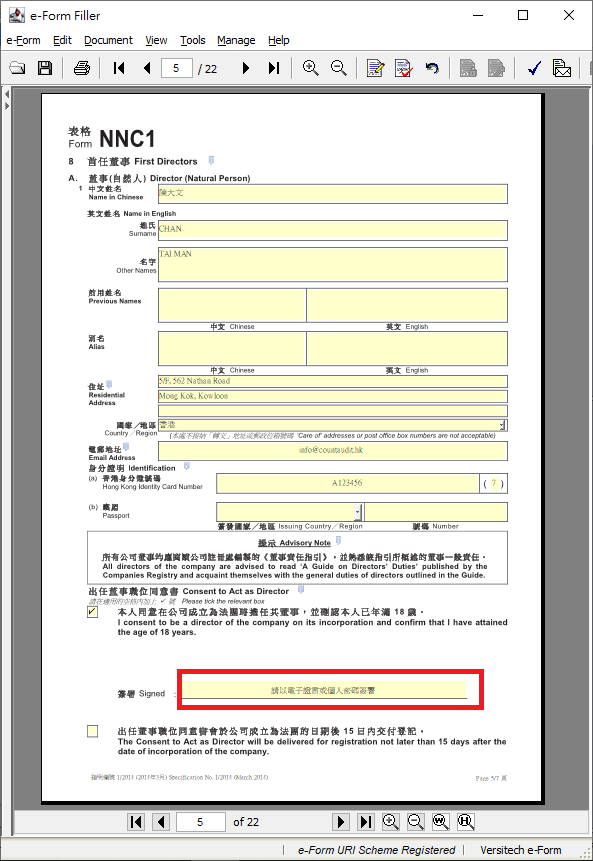

If the director chooses to sign electronically in the electronic form, the first thing to do is to press the button as shown in the above figure and to electronically sign the director’s position agreement on page 5.

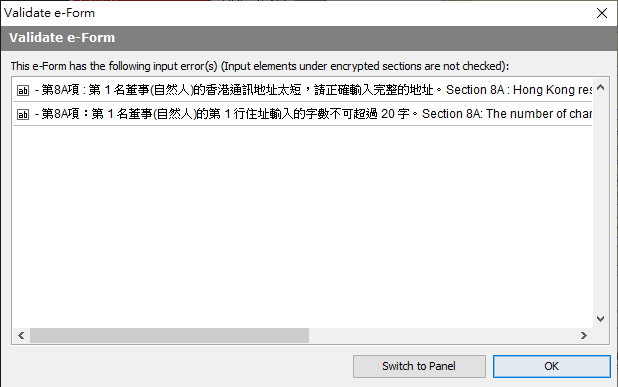

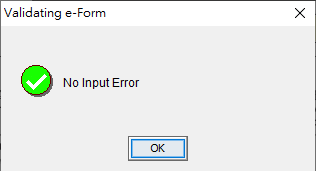

If the information is incorrect, the above window will be popped out to point out what the system believes is wrong. You can press ‘OK’ to amend.

You can click the relevant yellow box to amend the necessary content. Then, click the signature button.

If the information is correct, a window with No Input Error will pop out. Please click ‘OK’ to proceed to the next step.

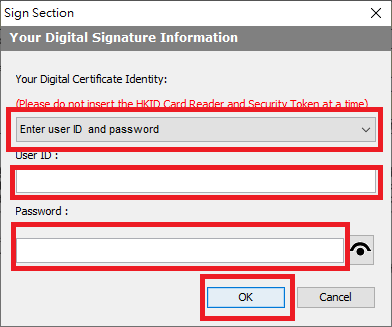

Choose ‘Enter user ID and password’ and fill in your ‘e-Registry’ user name and password. The electronic signature is done by clicking ‘OK’ .

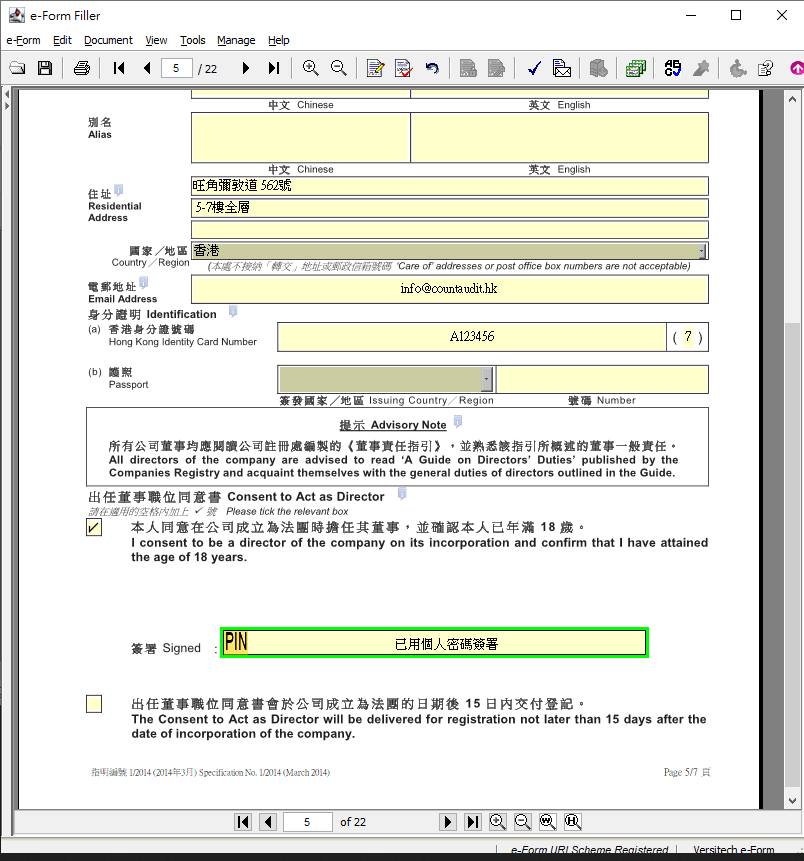

The button will look like the above figure after signing successfully.

Business registration period

Then, please go to page 7 and press the button in red frame.

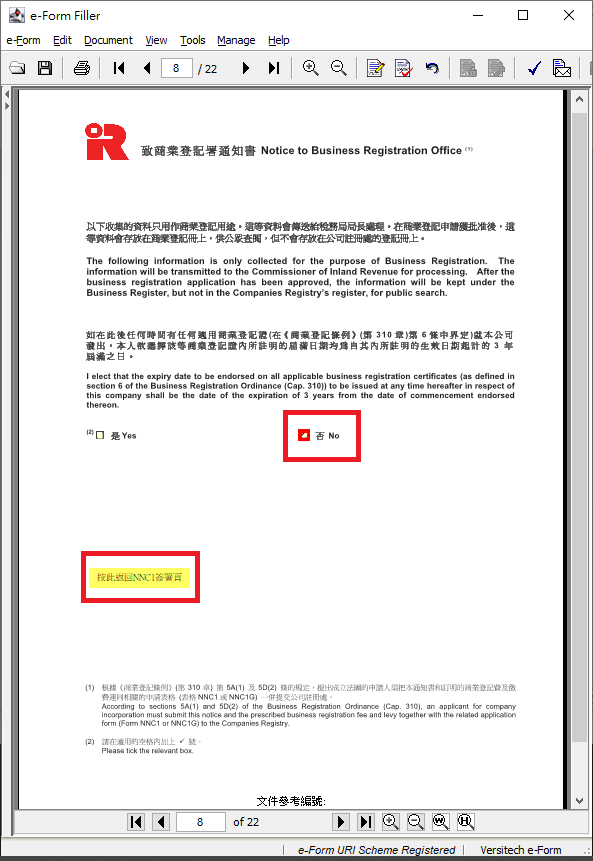

Click ‘No’ on this page, meaning that company will pay the business registration fee annually instead of paying in one go for three years. It is more cost-effective to pay annually as the Government always waive business registration fee. (Click here for details about business registration fee)

Click the yellow button in the bottom after choosing ‘No’.

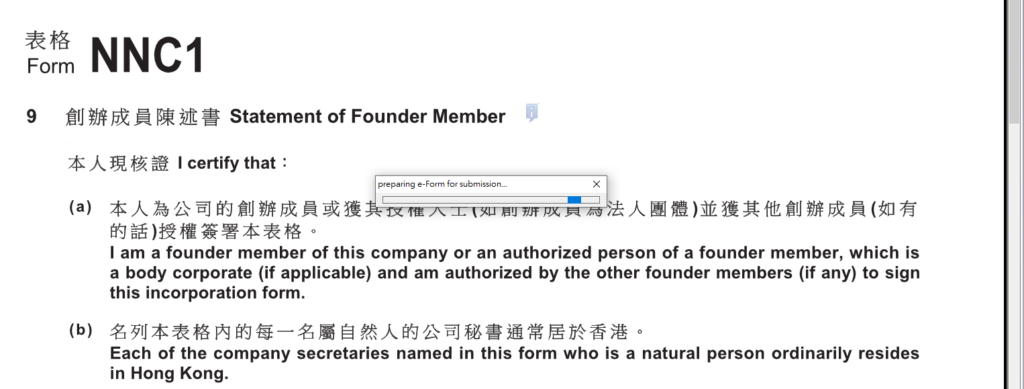

Signature and submission of founding members

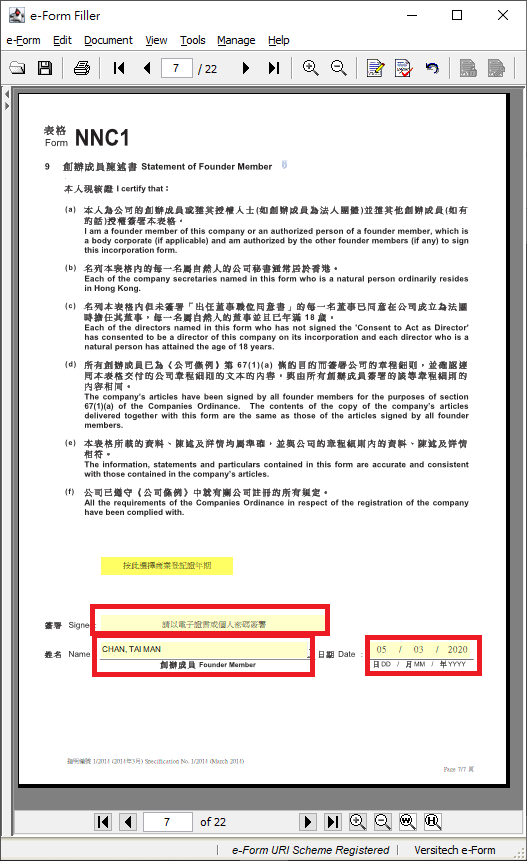

Go to page 7 and choose the name of founding member. Fill in the date of today and click the button next to signature.

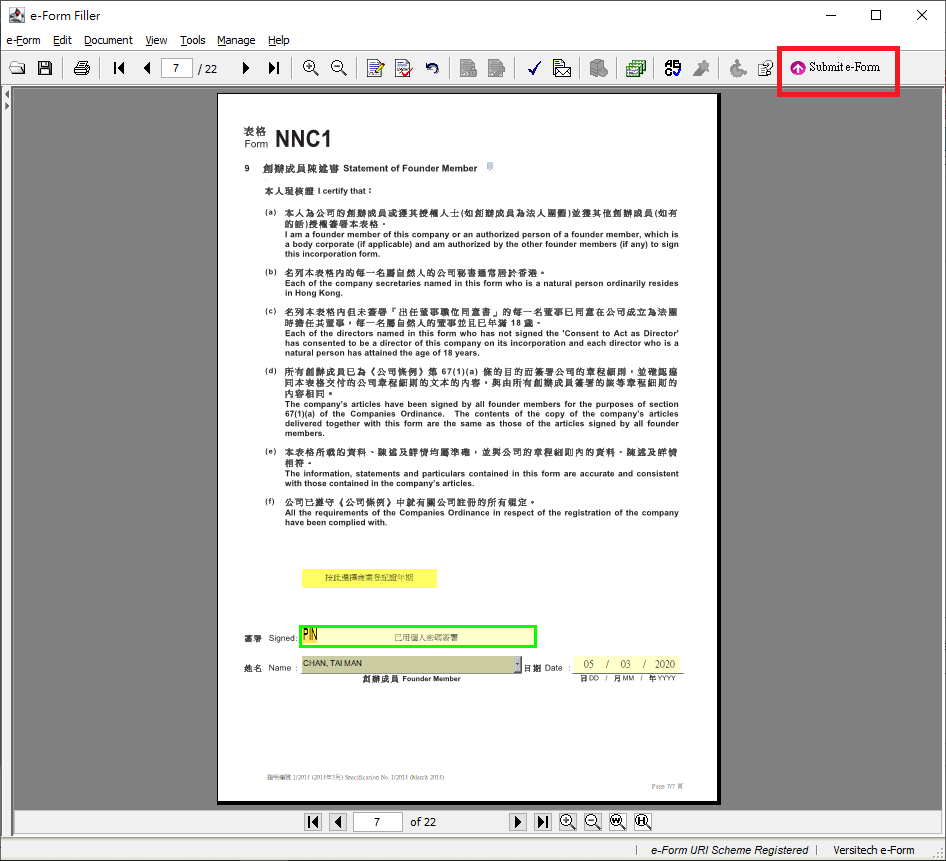

By using the electronic signing method previously shown, you will see the above figure. Then, click ‘Submit e-Form’ button on the top right corner of the window.

A preview form will pop out for review again. Click ‘Submit’ if there is no problem.

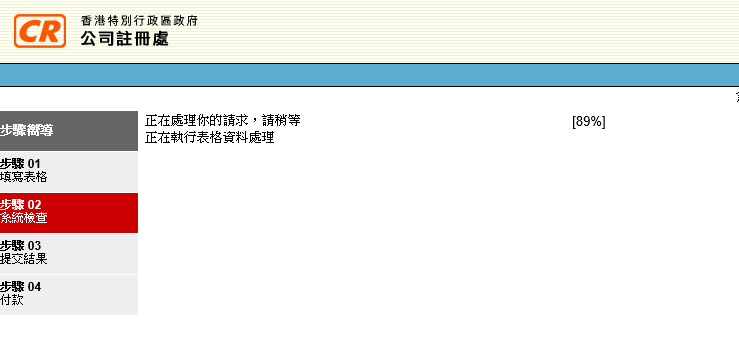

The system takes a while for loading.

At last, the system checks whether information and signature inputted are correct.

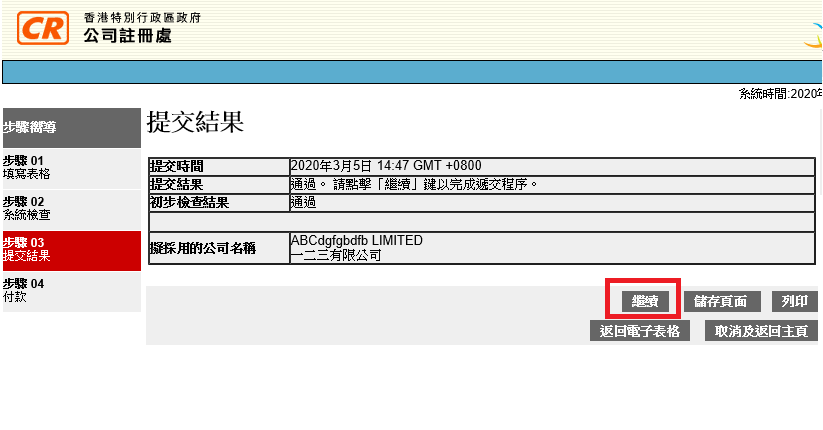

If there are any mistakes, they will be pointed out in the above figure. You can click the modify button to amend the relevant mistake with e-Form filler and submit again. If everything is correct like the above window, click ‘Continue’.

Then, the payment details will be listed. You can choose to pay by credit cards or PPS. After that, click ‘Continue’ to the payment page and do the payment. The application is done!

You can visit message box in the e-Registry account to check the approval process. Registry will send two important documents to the message box within few hours. They are Certificate of Incorporation ‘CI’ and Business Registration Certificate. This represents that your company has been set up officially.

Follow-up tasks for registered company

There are of course many follow-up tasks after registration, otherwise those accounting secretarial firms would not earn that much profit. You can save few thousands or more than ten thousands if you choose to deal with the following tasks by yourself. However, you may need to spend some time (you may also contact us CountAudit to continuously teach you what to do without cost). You can also pay us CountAudit or other accounting secretarial firms for help.

No matter what you choose, you as the owner or person-in-charge of a company, have the legal responsibility to understand what follow-up tasks you should do. It is rather complicated to completely explain details of each task. We will write a few more articles to discuss each topic later on. Here, we are going to list some of them to give everyone a rough idea:

Keep important company documents

According to Hong Kong Legislation Cap.622 Companies Ordinance (‘the new ordinance’), companies bear the responsibility to keep important statutory equipments and documentary records in the registered office or other designated places.

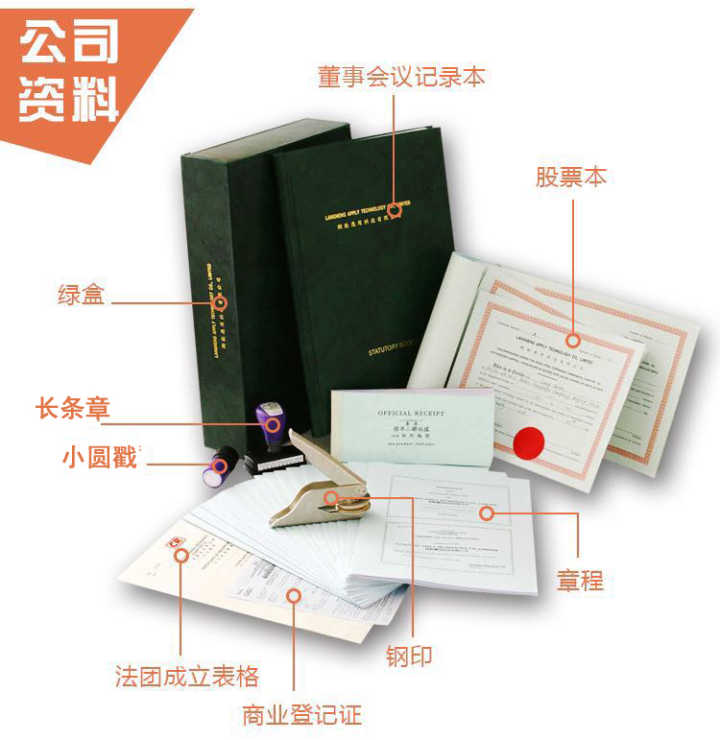

Secretarial firms publish some kit sets called Company Kit to benefit every company founder from ensuring that nothing has been missed.

Company Kit includes:

- 1. Articles of association of the company

- 2. Company common seal

- 3. Company signature stamp

- 4. Company circular stamp

- 5. Share certificate book

- 6. Statutory book

- 7. Significant Controllers Register

- 8. Certificate of Incorporation

- 9. Business Registration Certificate

- 10. Copies of government documents (e.g. NNC1 and NNC3)

The necessity of materials in 'Green Box' (Company Kit)

It seems so many documents! However, is it necessary to print and keep all of them? We will separate the above ten items into few types to explain:

Firstly, the green box holding the company’s company kit is not needed. The purpose of it is to pack all documents together to make storage easier. However, this hard box occupies quite a large space for many people. Company founders can keep these important documents in suitable containers according to their preferences.

For #2, it is a common seal. In the past, if companies executed some important documents like deeds, they must use the company common seal. However, according to Article 124(1) of the new Ordinance, companies can choose whether to keep and use the company common seal. Therefore, #2 is no longer necessary.

Move on to #7. According to Companies (Amendment) Ordinance 2018, all companies incorporated in Hong Kong (except listed companies) must keep the Significant Controllers Register for inspection by law enforcement officers. Therefore, #7 is necessary. Although the chance is not great, Registry has the possibility to perform surprise checks and issue tickets immediately.

Regarding #3 and #4, they are not required by Companies Ordinance. However, these two stamps are important for your daily operation (e.g. issuing invoice, signing contract, setting up bank account etc.). Therefore, it is practical to get them as soon as possible.

In terms of #5 and #6, the share certificate book is used for issuing new shares subsequently with low necessity while the statutory book is used for keeping names of directors, shareholders and secretaries as well as meeting minutes of directors and shareholders etc. Therefore, the statutory book is not necessary but the contents inside are necessary.

Though it is said to be necessary, the above records are unnecessary to be printed out. Article 655 in Cap.622 Companies Ordinance mentions that:

Therefore, you can use your own way to make a register to keep the above company records.

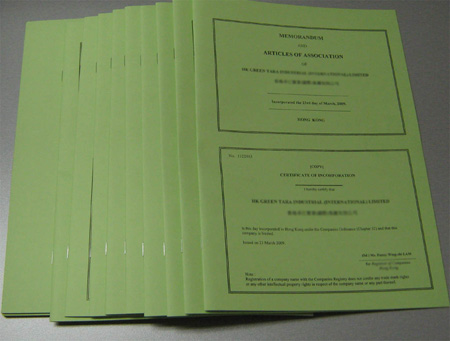

Finally, move to #1, #8, #9 and #10. They are very important company certifications that banks are going to ask for when setting up bank accounts. Therefore, they should be kept electronically or/and physically. If you have followed the above way and used ‘e-Registry’ to set up company, #8 and #9 were sent to the message box of your ‘e-Registry’ account. If you have visited Companies Registry in person to set up company, they were posted to the registered address of your company.

Regarding #1 Articles of Association, it is also named as ‘AoA’ or ‘書仔’. It is the basic normative company document about the organisation and behaviour that determines the rights and obligations of the company, directors and shareholders. At the time we set up the company, as the Registry automatically provided the ‘Sample A (Simplified Form)’ for ‘Model Articles of Association’, otherwise we would need to revise and modify this ten-page legal document. Even so, you as a core member in the company, must read this ‘Model Articles of Association’ carefully to understand your rights and obligations in order to avoid any behaviours breaching the company law.

Search your own company

The above-mentioned #1 and #10 in fact can easily be downloaded from Companies Registry Cyber Search Centre with administrative fee of ten or more dollars.

Actual steps are as follows:

After entering the website, and reading their announcements, scroll down to the bottom and click ‘To enter Companies Registry…’.

Then, click ‘Unregistered User’ to enter Search Centre.

You will be required to fill in their questionnaire. Randomly tick a box in (1)-(9) and click ‘Accept, Submit & Login’.

Click ‘Search – Image Record (including Document Index)’ under the header banner after entering the Search Centre system.

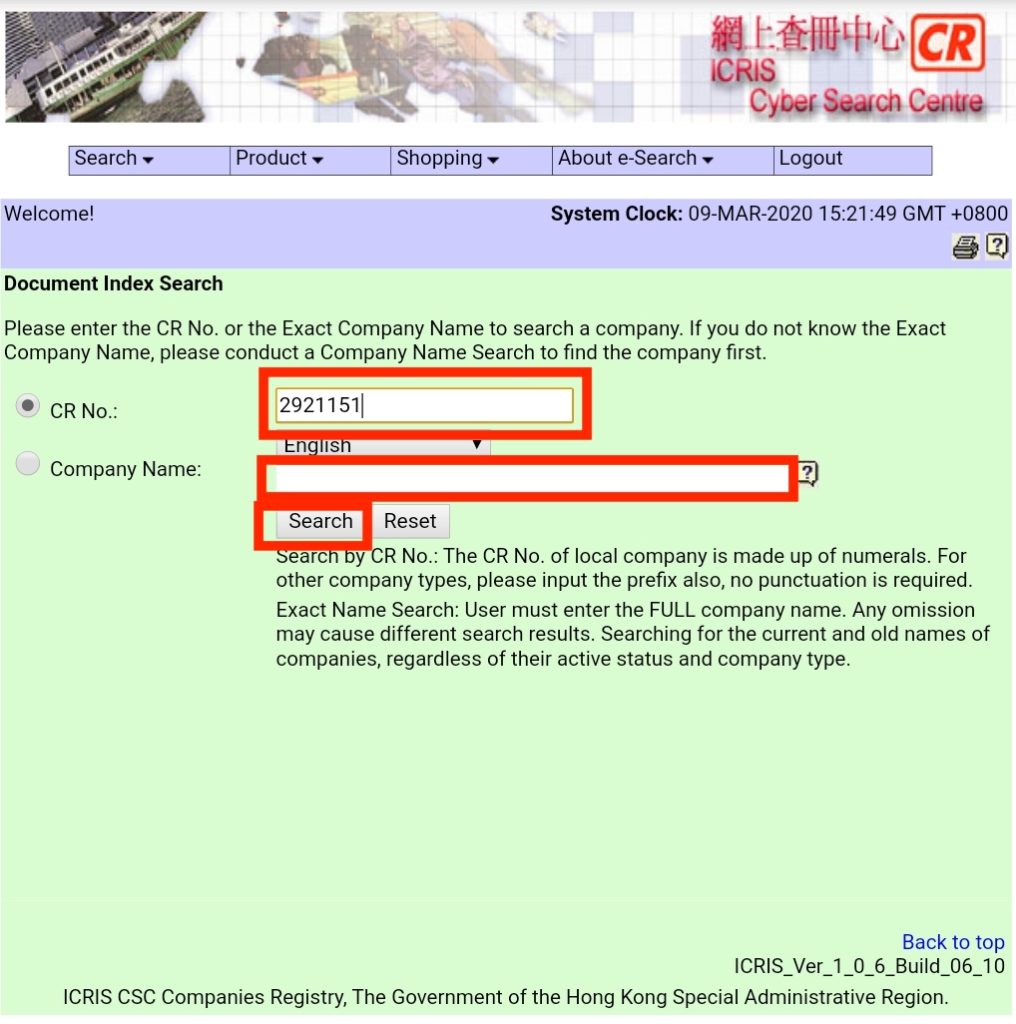

Fill in the CR No. of your company (CR No. can be found in Certificate of Incorporation) (note that it is not BR No.). Then, click ‘Search’.

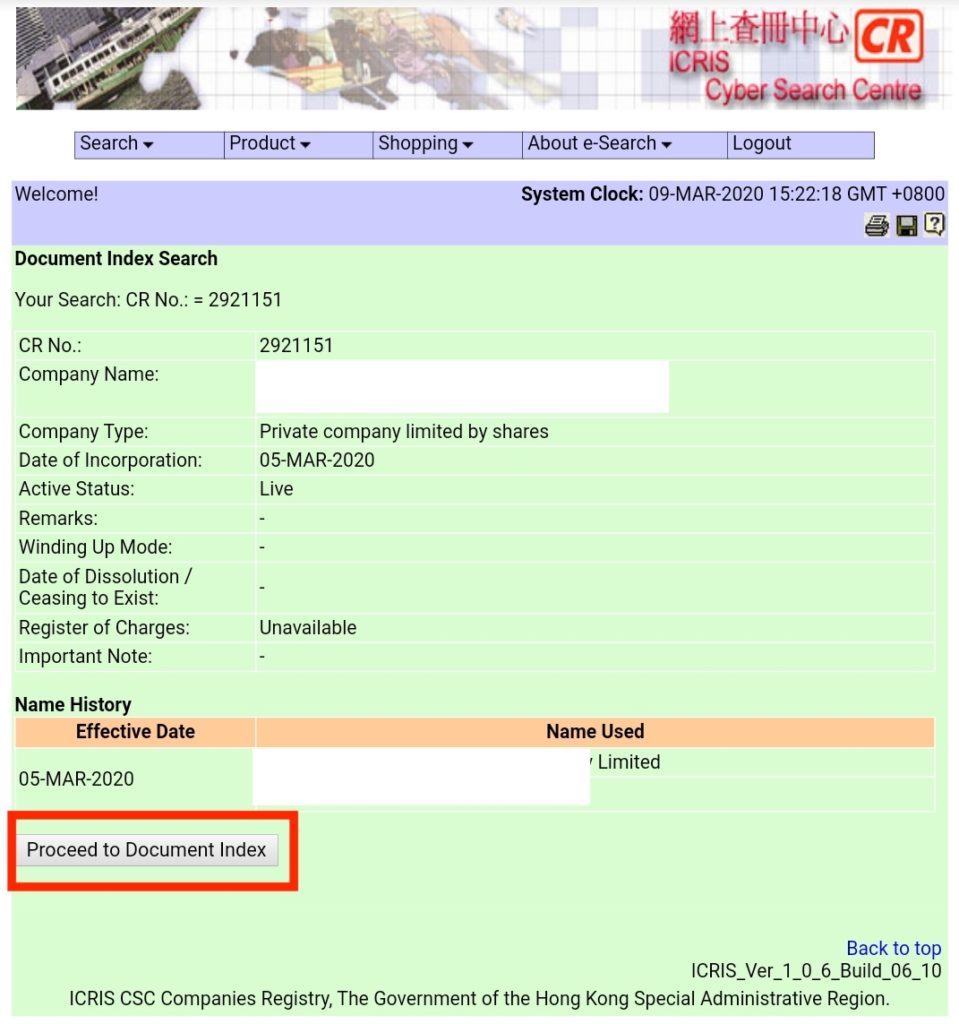

Here lists the important information of your company. Click ‘Proceed to Document Index’.

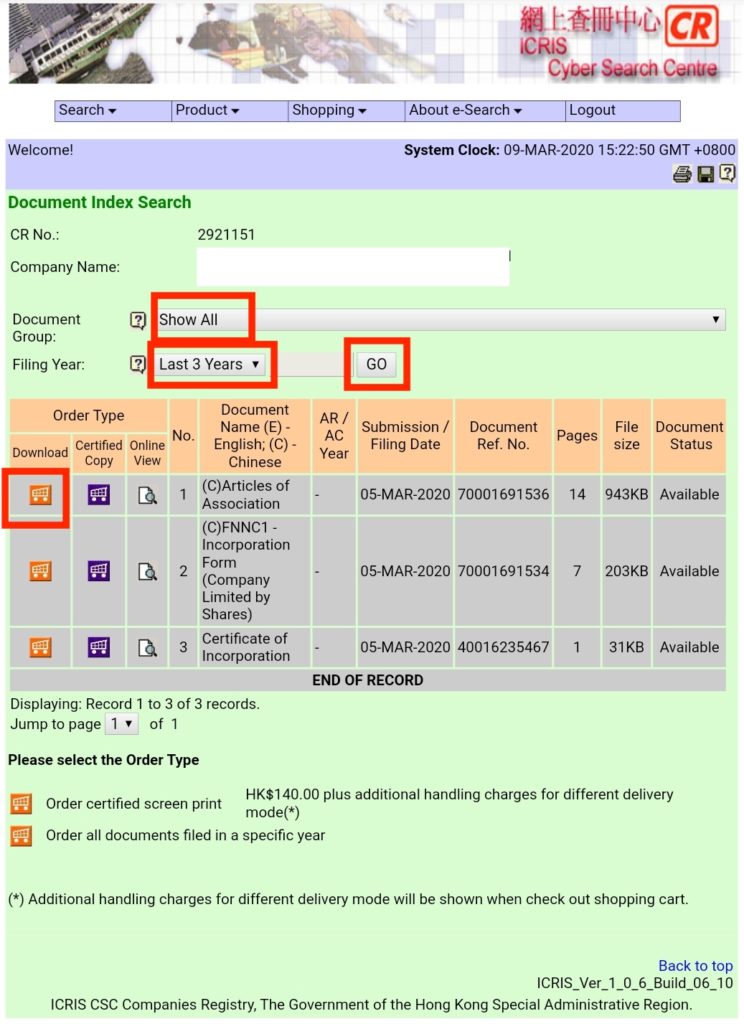

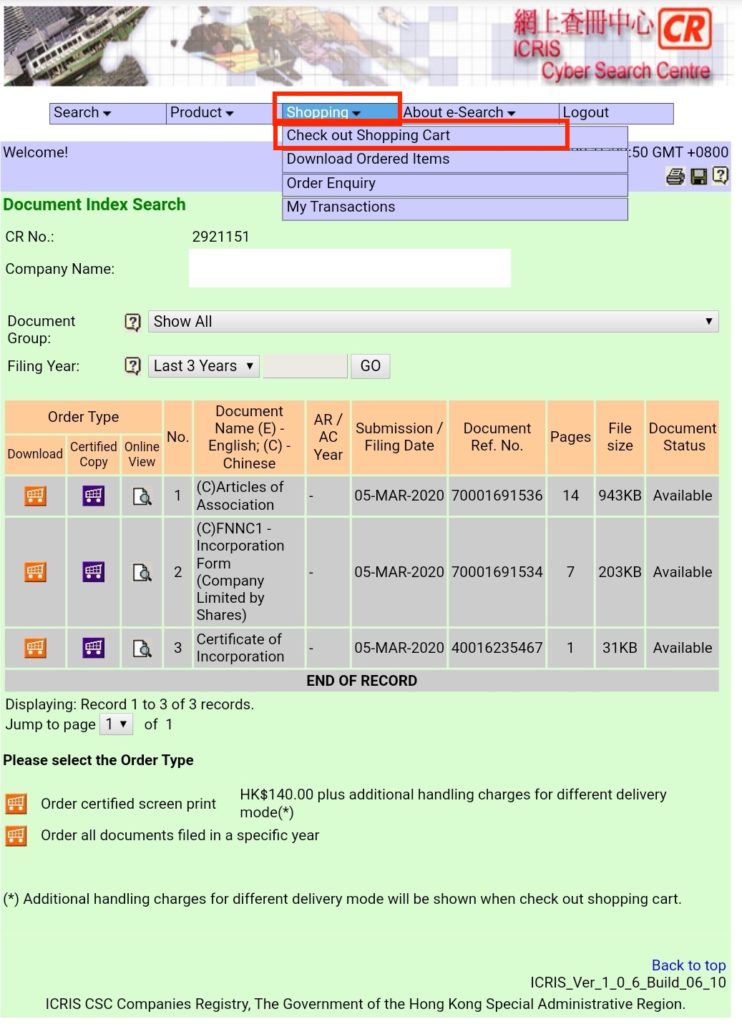

Choose ‘Show all’ in ‘Document Group’ and choose a longer period of time in ‘Filing Year’. Then, click ‘GO’ to pop out the list below. This is the documentary index of documents submitted to Registry by the company. Choose the documents you would like to keep (e.g. Article of Association and Incorporation Form) by clicking the download button on the left.

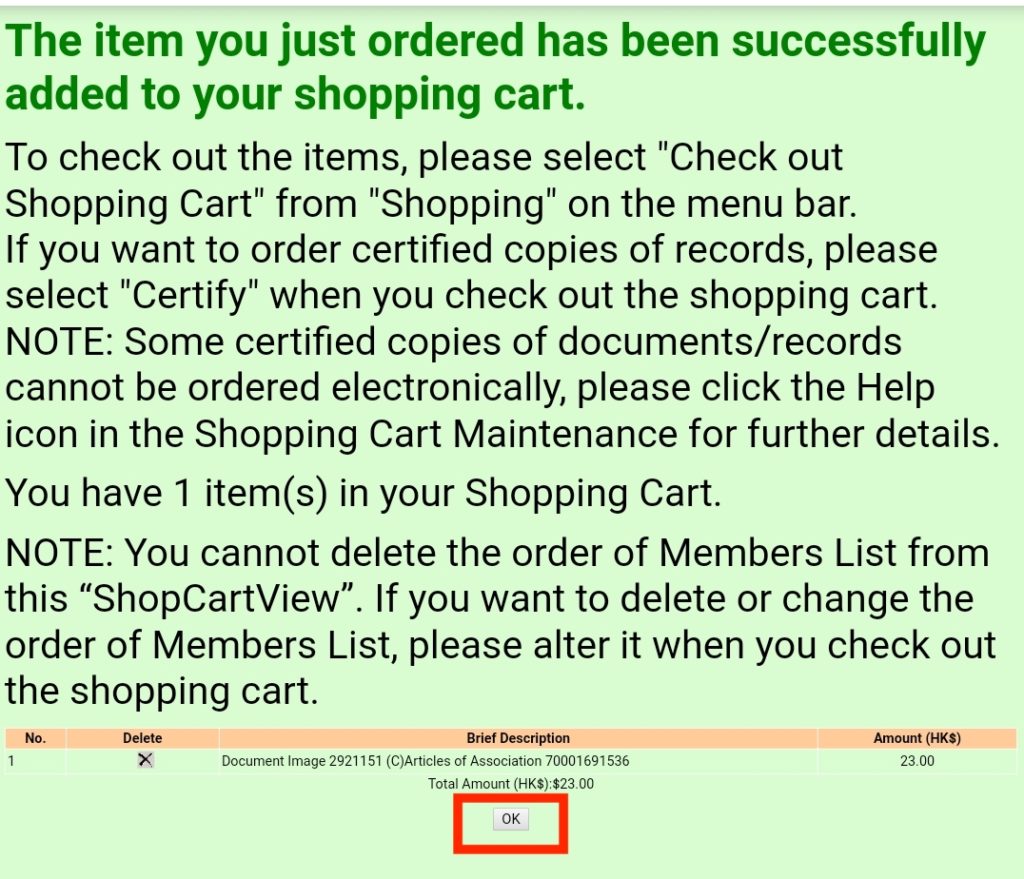

Then, a notice will show you that the item you ordered has been added to the ‘Shopping Cart’. Click ‘OK’ to continue.

Click ‘Shopping – Check out Shopping Cart’ in the menu at the top to pay after finishing ‘Shopping’.

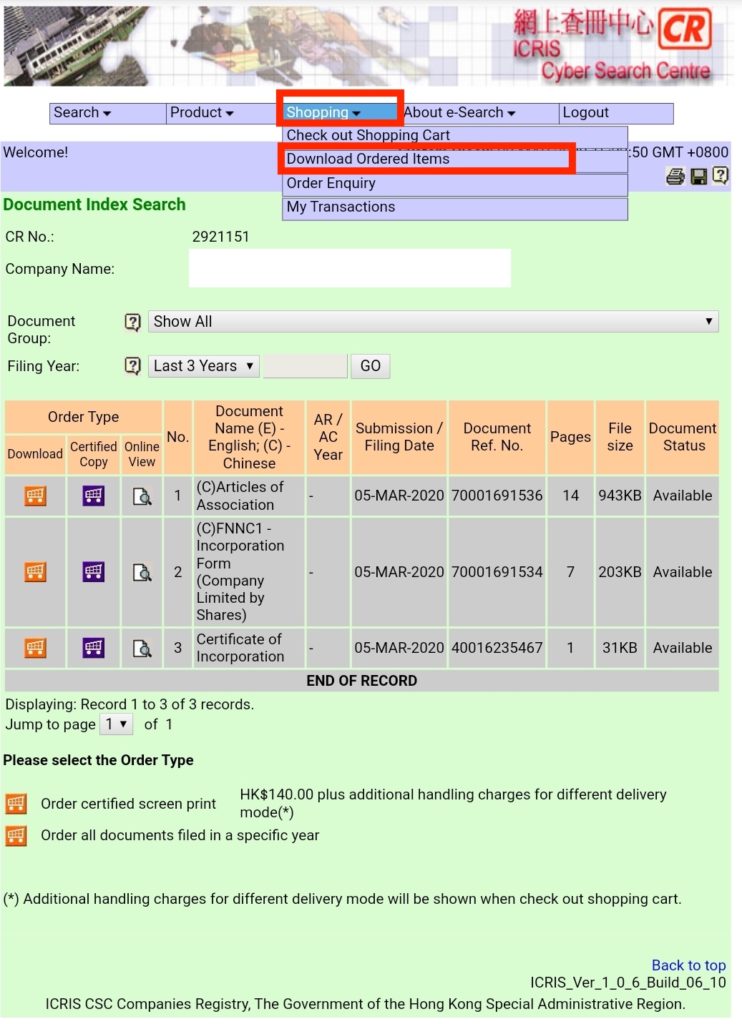

Tick the box next to the document you would like to purchase and click ‘Save and Checkout’. Finish the payment according to the instruction and mark down the ‘Order No.’ and ‘Order Enquiry Reference No.’.

Click ‘Shopping – Download Ordered Items’ in the menu at the top and input the ‘Order No.’ as well as the ‘Order Enquiry Reference No.’ to download the documents.

Company secretarial task

The position of company secretary has currently become professional administrative staff from subordinate class of labour in few decades ago. We have mentioned before that if you are unwilling to spend money employing secretarial company, you may put down a partner’s name or even your name. The person has to bear relevant obligations.

The obligations of company secretaries in SMEs include the following:

- Keep, sort and update the above important company documents

- Submit Annual Return within designated time annually to avoid penalty fines

- Attend Shareholders' Meetings and Annual General Meeting (AGM) and compile minutes

- Attend shareholders' meetings regarding important company events (e.g. changing of directors, issuance or transfer of share capital) and compile minutes, then submit relevant forms to Companies Registry

We have explained in detail about the company secretarial task in subsequent articles.

Keep accounting records

Regarding how to keep accounting records, we will explain it in Accounting1001 articles later on. Here, I extract some provisions from Article 373 of Cap.622 Companies Ordinance for understanding the requirements.

Know more/Useful links

1. NNC1 Incorporation Form Sample published by the Government

2. Sample A: Articles of Association for Private Companies Limited by Shares (Simplified Form)

3. Chinese and English versions of Hong Kong Legislation Cap. 622 Companies Ordinance

4. Companies Registry e-Registry website

5. Companies Registry Cyber Search Centre website