By CountAudit

The Government announced in the 2020-21 Budget that they are going to waive 2020/21 Business Registration Fee. This represents that the fee (that is for registering business for the first year) for setting up ‘unlimited company’ reduces from HK$2,250 to HK$250 from now to March 31 2021! Also, we are going to teach everyone how to one-stop online set up unlimited companies at home in the following passage. You do not need to leave home or queue at Inland Revenue Department.

Necessity and advantages of unlimited companies

According to Cap.310 Business Registration Ordinance, basically, as long as you are operating any business by yourself, you have to set up unlimited company within one month since the starting date of business. Details about businesses that require business registration are as follows:

1. any form of trade, commerce, craftsmanship, profession, calling or other activity carried on for the purpose of gain;

2. any corporation or association of persons formed for the purpose of affording its members facilities for social intercourse or recreation;

3. any limited company registered in Hong Kong;

4. any limited company with business location in Hong Kong but not registered in Hong Kong, no matter whether it is actually operating business in Hong Kong;

5. any limited company not registered in Hong Kong but has representative office or liaison office in Hong Kong, or lease their properties in Hong Kong, no matter whether it has business location in Hong Kong.

After setting up unlimited company, the owner (the boss) of the unlimited company has to fill in the business status, including sales amount, gross profit, net profit and assessable profit etc., in ‘Section 5’ when filing his or her own Tax Return. You may not be familiar with how to fill in the above items. We will write an article separately to explain this later on.

For some people who are doing business or/and receiving rental income, no matter whether they work or not, it is a very nice way to reduce tax amount by choosing ‘Personal Assessment’ in Tax Return. After choosing ‘Personal Assessment’, they can file their salaries tax, unlimited company profit tax and property tax together. If their unlimited company business incurred a loss, the loss could be used to offset the income earned from working. If the unlimited company earned a profit or received rental income, it is also possible to use personal assessment allowance (2019/20 basic allowance is HK$132,000) to offset the profit or rental income. Therefore, taxes can be lawfully reduced anyway.

Apart from reducing taxes, by setting up unlimited company, entrepreneurs can use company name to register a separate bank account to collect money from clients. Entrepreneurs can also use company name instead of personal full name when signing contract and issuing invoice to clients. This looks more formal when we are working freelance or small businesses. We can avoid exposing too much personal information as well.

Register eTax Account

As there are so many advantages and high necessity to set up unlimited companies, entrepreneurs who have the need to set up one should stop waiting and take action immediately. Firstly, we have to activate our eTax account to online set up unlimited company. As long as you have received Notice of Assessment or Tax Returns from Inland Revenue Department before, you can register eTax account at home. Procedures are as follows:

Firstly, please enter ‘GovHK’ website:

https://etax13.ird.gov.hk/ird/login/jsp/LandingPage.jsp?userLang=zh&userCountry=hk

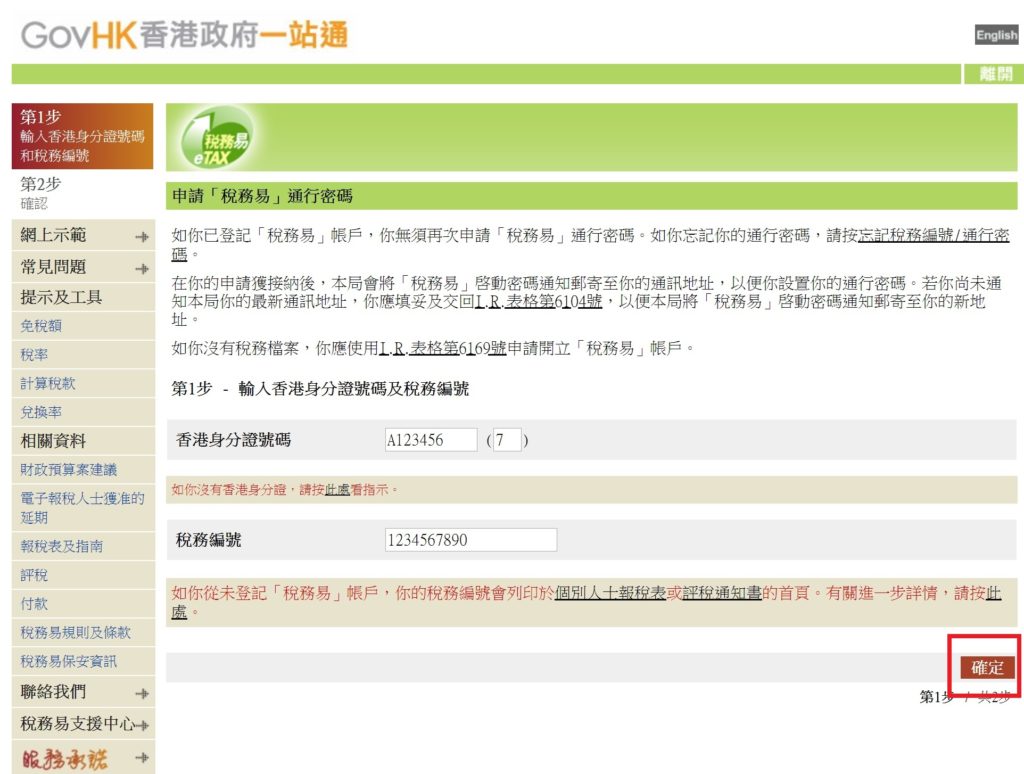

Then, click ‘Apply for eTax Password’.

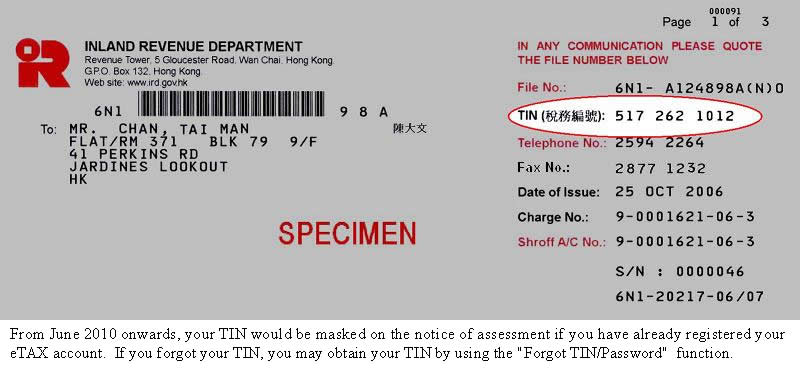

Then, fill in your identity card no. and your ‘TIN’.

Your ‘TIN’ can be found in Notice of Assessment sent to you by Inland Revenue Department. It is a ten-digit number.

Click ‘Confirm’ after inputting information.

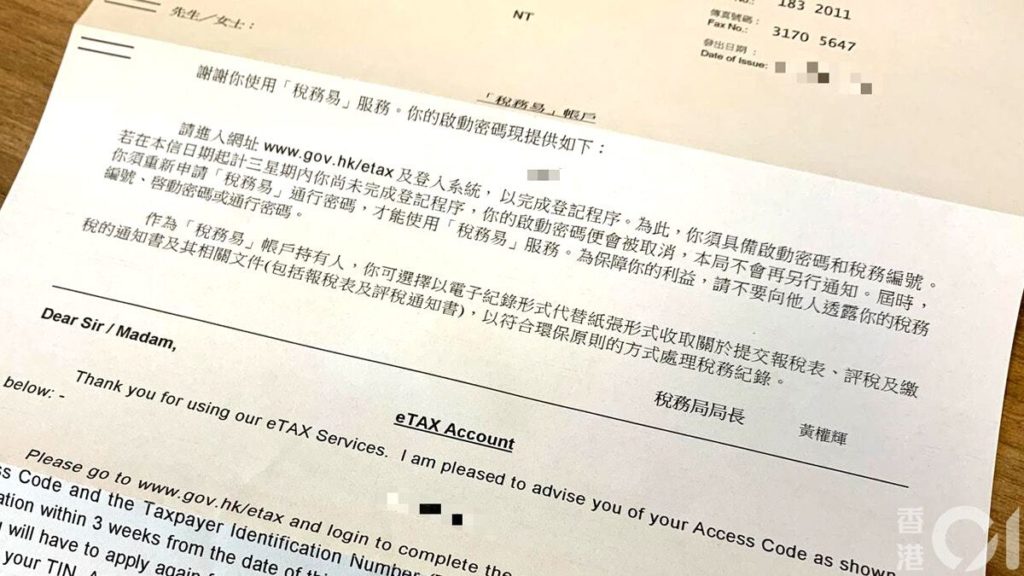

Then it is done! The Inland Revenue Department will send a letter involving access code to your address in around 2 working days. You can proceed to the next step after receiving the letter.

This is a sample letter with the access code for activating eTax account from Inland Revenue Department.

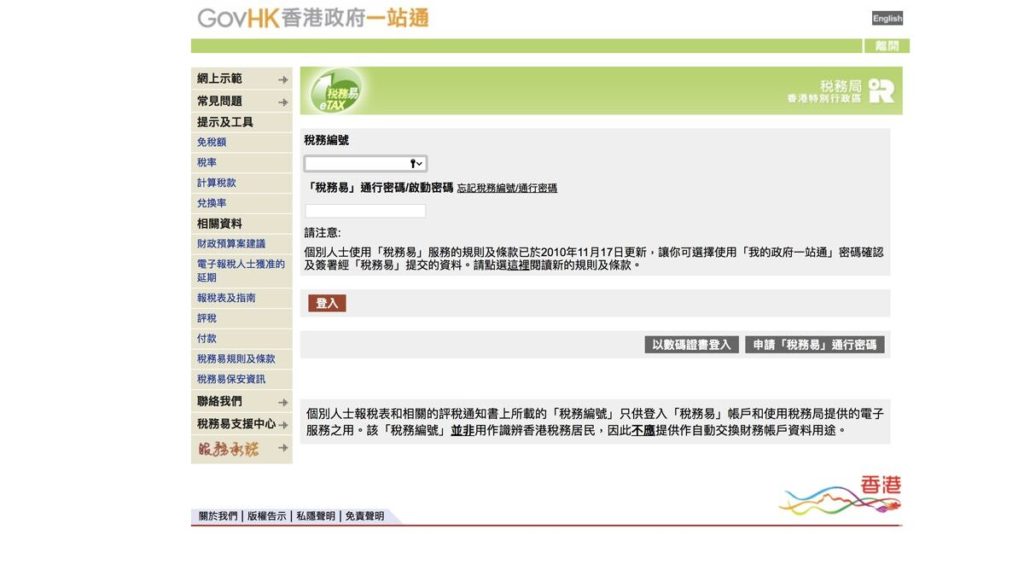

Enter the eTax website and click ‘Login’.

Click ‘Login’ after inputting TIN and the access code shown in the letter.

Then, you can reset your TIN and password according to your preference.

Your eTax account has been successfully registered after inputting personal information!

Use eTax to set up unlimited company

After login, choose ‘Online Service’ on the upper row.

Scroll down to Businesses, click ‘Application for Business or Branch Registration’.

After entering the page, click ‘start using service’ in the right bottom corner.

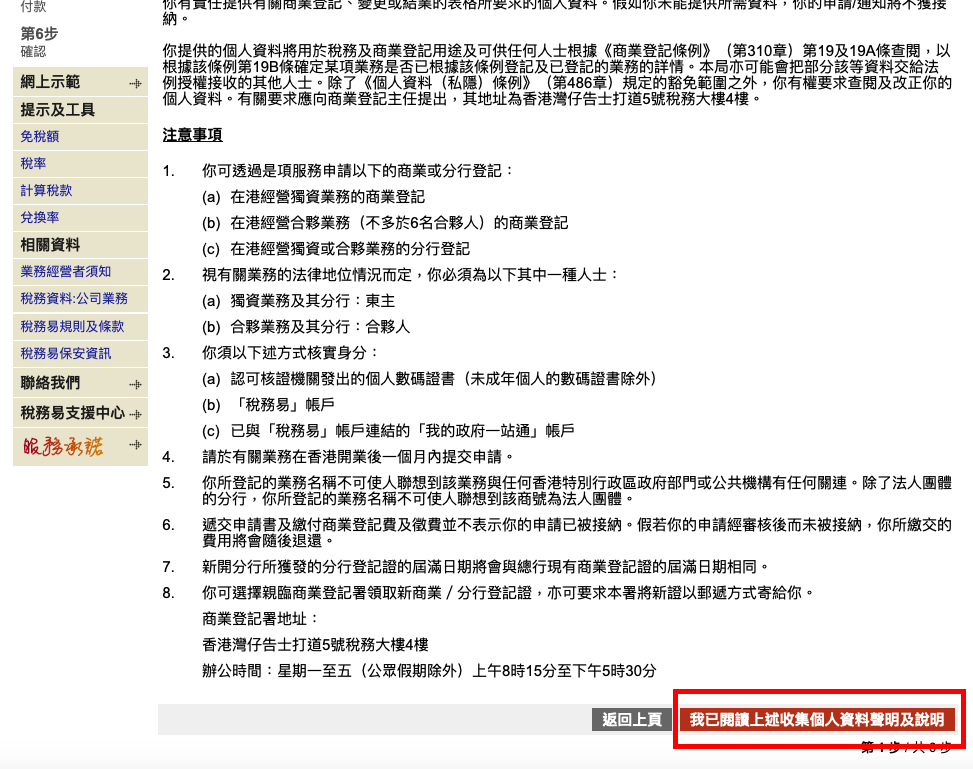

After reading the terms and announcements, click ‘I have read the above personal information collection statement and instructions’ in the right bottom corner.

To the second step, choose your application type. Click the circle next to your application type. Sole proprietorship is a business run by one owner while partnership is run by two or more owners. The third one operating branches is seldom used (usually use in restaurant businesses). Then, click ‘Continue’ in the right bottom corner.

To the third step, fill in your personal information. Choose your preferred title on the 1st row. Fill in English, Chinese full name and alias on the 2nd to 5th row. Fill in ID card no. on the 6th row. Fill in your address on the 7th to 10th row.

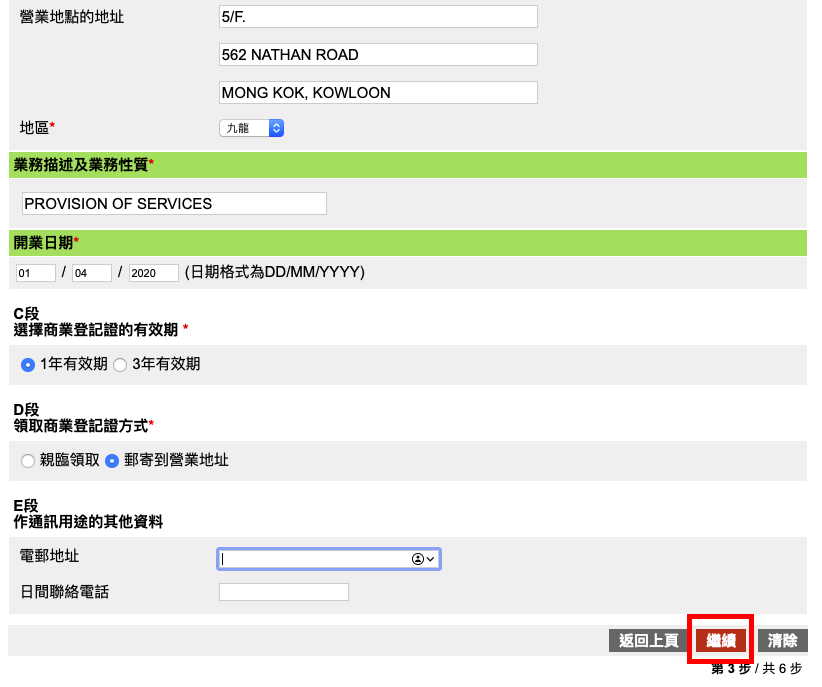

Move on to Part B. Fill in company’s English name on the 1st to 3rd row. Fill in company’s Chinese name on the 4th row. Fill in the address for doing business on the 5th to 8th row. Fill in the business nature on the 9th row (e.g. PROVISION OF SERVICES). There are no regulations or limitations on business nature but it may take time to approve for some businesses not usually seen. Fill in the business starting date on the 10th row. You have to fill in a date before or as at your application date.

For Part C regarding the Business Registration Certificate, you are advised to choose ‘For 1 year’ on the left. Although the three-year one is cheaper on ratio, the Government may waive business registration fee. It is more cost-effective to choose the one-year one.

For Part D regarding the receiving method of Business Registration Certificate, you can choose ‘By mail to business address’ on the right.

For Part E, leave it blank. Then, click ‘Continue’ in the right bottom corner.

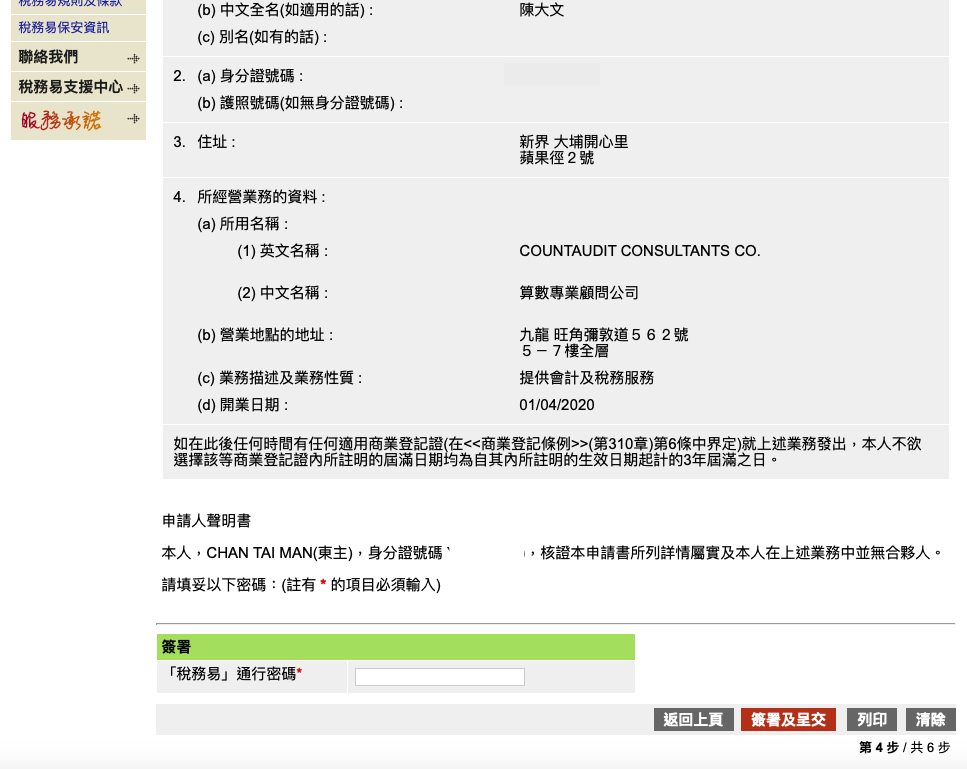

After entering the page, you can check whether the inputted information is correct. If there are mistakes, you may click ‘Back to previous page’ to make amendments.

After ensuring information is correct, fill in the eTax password in the bottom and click ‘Sign and Submit’ in the right bottom corner.

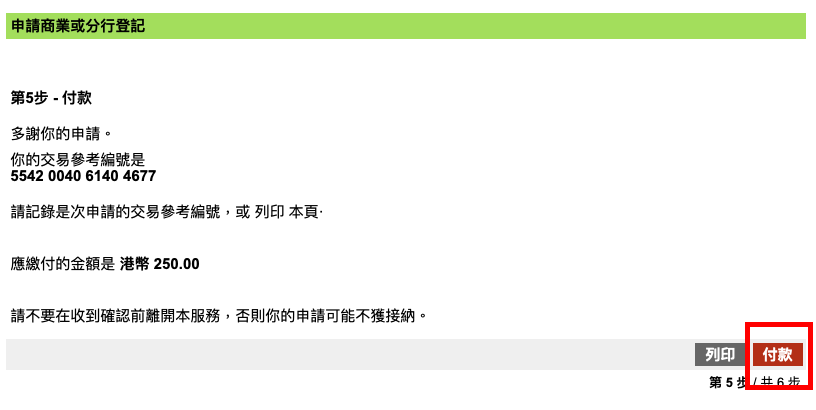

To the 5th step, please mark down the transaction reference number, or print the page. Then, click ‘Pay’.

It is the 6th step after finish the payment. It shows your application and payment are accepted. Click ‘Save’ and leave.

Other advantages of eTax account

Apart from setting unlimited companies, eTax account has many other usages, including:

- Submit personal tax returns

- Remind yourself when to submit tax returns

- Amend registered business information of unlimited companies, including name, nature of business and registered address etc.

- Pay stamp duties for transferring property and shares

- Pay taxes

- Submit profits tax returns

We will elaborate the usage of these functions in articles published later on.